What Does Mileagewise - Reconstructing Mileage Logs Do?

What Does Mileagewise - Reconstructing Mileage Logs Do?

Blog Article

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsGetting My Mileagewise - Reconstructing Mileage Logs To Work7 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described3 Simple Techniques For Mileagewise - Reconstructing Mileage Logs4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Explained9 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownThe Best Guide To Mileagewise - Reconstructing Mileage Logs4 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance attribute recommends the quickest driving course to your employees' destination. This attribute boosts productivity and contributes to cost savings, making it a crucial possession for organizations with a mobile workforce.Such a technique to reporting and compliance streamlines the typically complex task of taking care of gas mileage costs. There are numerous advantages connected with utilizing Timeero to maintain track of gas mileage.

An Unbiased View of Mileagewise - Reconstructing Mileage Logs

With these tools in usage, there will certainly be no under-the-radar detours to increase your reimbursement expenses. Timestamps can be discovered on each mileage entry, boosting trustworthiness. These extra verification actions will maintain the IRS from having a reason to object your gas mileage documents. With exact gas mileage tracking modern technology, your workers don't have to make rough gas mileage price quotes or even bother with mileage cost tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all cars and truck costs (mileage log). You will certainly require to proceed tracking gas mileage for work also if you're making use of the real cost method. Keeping mileage records is the only method to separate service and personal miles and provide the evidence to the IRS

A lot of mileage trackers allow you log your journeys by hand while determining the distance and repayment quantities for you. Several likewise come with real-time journey monitoring - you need to start the application at the beginning of your journey and stop it when you reach your final location. These applications log your start and end addresses, and time stamps, along with the complete range and repayment quantity.

Mileagewise - Reconstructing Mileage Logs for Dummies

Among the inquiries that The IRS states that lorry expenses have a peek at this website can be thought about as an "common and required" cost in the training course of doing business. This consists of costs such as fuel, maintenance, insurance policy, and the vehicle's devaluation. However, for these expenses to be considered insurance deductible, the vehicle ought to be made use of for service objectives.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

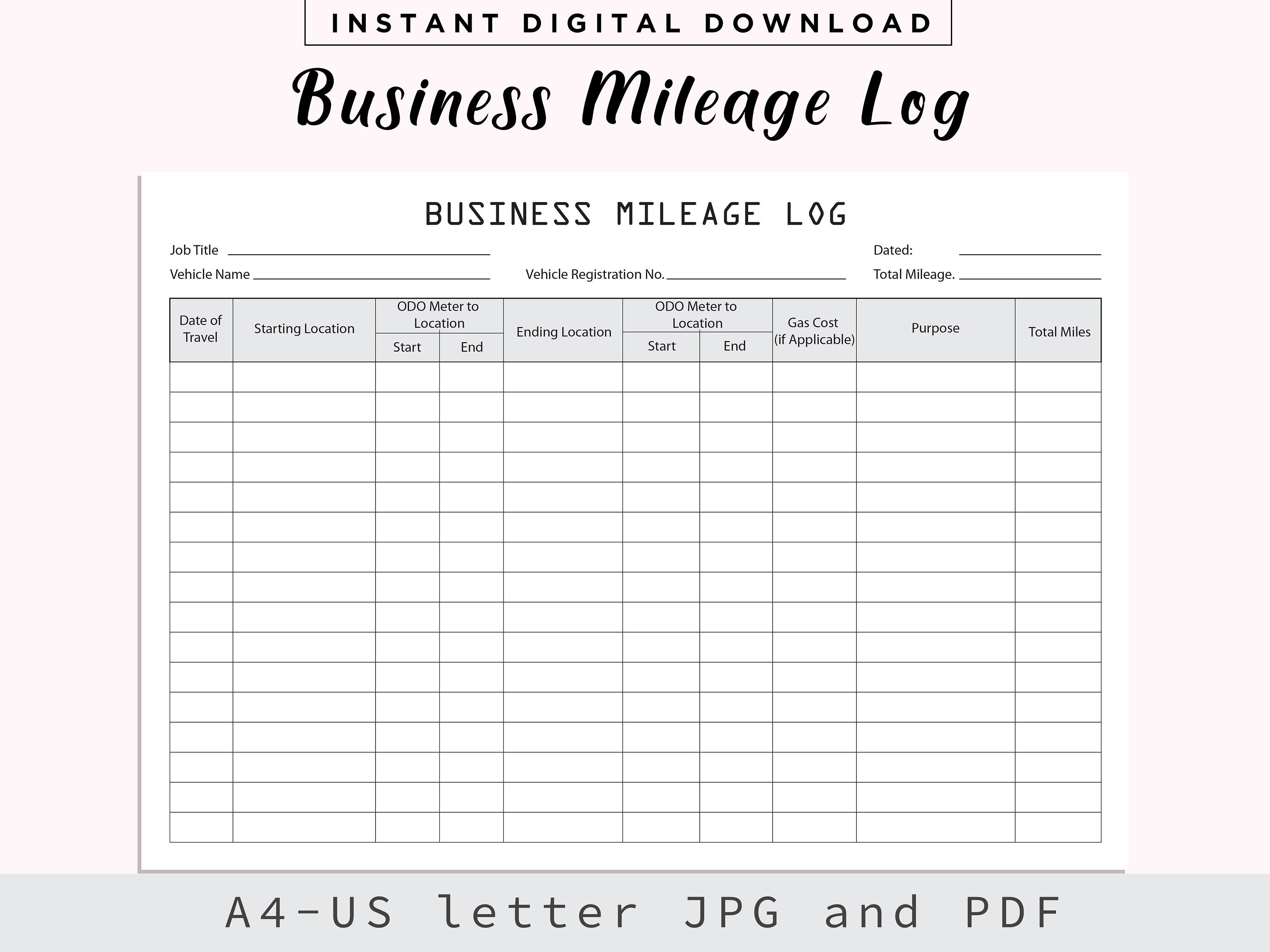

In in between, diligently track all your company trips keeping in mind down the beginning and ending readings. For each trip, record the place and service function.

This consists of the total business gas mileage and complete mileage accumulation for the year (organization + individual), trip's date, location, and objective. It's essential to tape-record activities promptly and maintain a simultaneous driving log detailing day, miles driven, and organization objective. Here's how you can improve record-keeping for audit purposes: Beginning with making sure a thorough gas mileage log for all business-related travel.

Some Known Factual Statements About Mileagewise - Reconstructing Mileage Logs

The actual costs technique is an alternate to the standard mileage rate approach. As opposed to calculating your deduction based on a predetermined rate per mile, the real expenditures approach permits you to subtract the actual costs linked with using your car for company objectives - mileage tracker. These expenses include fuel, upkeep, fixings, insurance policy, depreciation, and various other related expenses

Those with substantial vehicle-related expenditures or distinct problems might profit from the real costs approach. Please note electing S-corp standing can change this estimation. Eventually, your chosen approach should line up with your details financial goals and tax obligation situation. The Standard Gas Mileage Rate is a measure released each year by the IRS to establish the deductible prices of running an auto for service.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

(https://www.storeboard.com/mileagewise-reconstructingmileagelogs)Whenever you use your vehicle for organization journeys, tape-record the miles took a trip. At the end of the year, once again write the odometer analysis. Calculate your overall business miles by utilizing your beginning and end odometer readings, and your videotaped business miles. Properly tracking your exact gas mileage for service journeys aids in confirming your tax obligation reduction, particularly if you opt for the Requirement Gas mileage technique.

Keeping track of your mileage by hand can need persistance, but bear in mind, it can conserve you money on your taxes. Comply with these actions: Jot down the date of each drive. Tape-record the complete gas mileage driven. Take into consideration noting your odometer analyses before and after each trip. Write the beginning and finishing points for your trip.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline sector became the initial industrial users of general practitioner. By the 2000s, the shipping industry had taken on general practitioners to track packages. And now almost every person utilizes general practitioners to navigate. That indicates almost everyone can be tracked as they go concerning their business. And there's snag.

Report this page